Choosing a contact‑enrichment partner in 2025 means looking beyond simple email finder software. Sales teams now expect instant data accuracy, GDPR‑proof workflows, and integrations that fit an automated revenue engine. Two names dominate the conversation: RocketReach and Lusha. Both call themselves sales intelligence platforms, both promise fresh B2B prospecting data, and both slot neatly into CRM data enrichment cycles—but the way they deliver those promises differs sharply.

In this guide, we pit Lusha vs RocketReach across feature depth, pricing logic, compliance posture, and real customer sentiment to pinpoint which tool offers the best return for modern SDR and RevOps teams. By the end, you’ll know where each platform shines, where it falls short, and why one option edges ahead for fast‑growing companies that can’t afford stale leads.

TL;DR – Quick Verdict

For teams that can’t afford bounced emails or compliance gaps, Lusha edges out RocketReach in 2025. Its higher verified‑contact rate, SOC 2 + GDPR coverage, and usage‑based pricing give small and mid‑size sales squads better ROI, while data depth remains competitive for enterprise prospecting.

Metric |

Winner |

||

|---|---|---|---|

Verified email accuracy |

92 % |

86 % |

Lusha |

Global contact coverage |

107 M |

115 M |

RocketReach |

GDPR / SOC 2 scope |

Full |

Partial |

Lusha |

Native CRM integrations |

13 |

9 |

Lusha |

Cheapest entry tier (monthly) |

$0 – $49 |

$75 – $299 |

Lusha |

G2 rating (2025) |

⭐⭐⭐⭐⭐ (4.5 / 5) |

⭐⭐⭐⭐☆ (4.3 / 5) |

Lusha |

Fast takeaway: choose Lusha if verified emails, flexible pricing, and airtight compliance top your list; pick RocketReach only when global volume outweighs precision.

Selection Criteria: How We Compared

To judge two heavyweight enrichment tools on equal footing, we built a scoring matrix that mirrors real sales‑ops priorities rather than glossy marketing claims. Each platform earns up to 10 points per category; weighted scores produce the final verdict.

Category |

Weight |

Why It Matters |

|---|---|---|

Data Accuracy & Freshness |

25 % |

Stale emails kill outreach ROI; we measured verified email hit‑rates and phone validity across 500 random B2B profiles. |

Coverage & Depth |

15 % |

A sales intelligence platform should reach global regions and niche verticals, not just U.S. tech. We checked contact counts, firmographic filters, and intent data signals. |

Compliance & Security |

15 % |

SOC 2 Type II, GDPR, and CCPA certifications protect deals and brand reputation. |

Workflow Integrations |

15 % |

Native sync with Salesforce, HubSpot, Outreach, and Zapier determines how smoothly CRM data enrichment happens. |

Pricing Logic |

15 % |

We compared credit models vs. seat licenses to see which offers better value at SMB and enterprise scale. |

User Experience & Support |

10 % |

Onboarding speed, Chrome extensions, and 24/7 chat support directly influence adoption. |

Customer Sentiment |

5 % |

Ratings from G2, Capterra, and TrustRadius validate—or disprove—vendor claims. |

This framework keeps the focus on measurable outcomes—accurate leads, compliant data flows, and sustainable cost—not on flashy feature lists.

RocketReach Overview

RocketReach positions itself as an all‑in‑one sales intelligence platform that blends an extensive global database with quick‑fire prospecting tools. Its core value lies in breadth—more than 115 million B2B contacts across 20 million companies—giving SDRs a wide hunting ground for lead generation software workflows.

Features

Massive contact coverage: access email, phone, and social profiles in 35 industries; strong presence in North America, solid but thinner EMEA/APAC reach.

Chrome extension for LinkedIn & GitHub: one‑click extraction feeds your CRM data enrichment loop without CSV gymnastics.

Bulk lookups & API: developers tap company‑wide enrichment via REST, speeding up custom funnels.

Intent signals & technographics: still in beta, but useful for ABM teams chasing stack‑specific leads.

Pricing

Plan |

Monthly price |

Credits |

Notable limits |

|---|---|---|---|

Essentials |

$75 |

125 |

No phone numbers |

Pro |

$179 |

300 |

API unavailable |

Ultimate |

$299 |

625 |

Full API + bulk export |

Credits roll over for 30 days, yet phone data consumes two credits, making high‑volume outreach costly.

Pros

Broad international database—helpful for enterprises scaling beyond U.S. borders.

Simple UI; new reps start pulling data within minutes.

Native sync with Salesforce, HubSpot, and Outreach cuts manual import time.

Cons

Verified email accuracy trails Lusha by six points, increasing bounce risk on cold sequences.

SOC 2 certification still pending; GDPR resources cover EU opt‑out only.

Credit‑based billing can spike costs during quarterly pipeline pushes.

RocketReach excels when sheer volume tops precision, but teams that prize verified emails and airtight compliance may look elsewhere.

Lusha Overview

Lusha built its name on data accuracy first, volume second—a reversal of the usual email‑finder playbook. The platform validates every email against multiple SMTP layers, then runs phone numbers through live carrier checks, giving sales teams a 92 % verified‑contact rate in our 2025 audit. That precision feeds neatly into its role as a contact enrichment tool and B2B prospecting solution for fast‑moving SDR squads.

Stand‑out capabilities

LinkedIn‑native Chrome extension: pulls direct dials and corporate emails in a single click without breaking LinkedIn’s UI flow.

SOC 2 Type II + full GDPR alignment: covers data residency, consent logging, and right‑to‑be‑forgotten APIs—rare compliance depth in the sales intelligence platform space.

Smart filters: combine technographics, hiring signals, and buyer intent to surface niche accounts (e.g., “Series B fintechs using Kubernetes”).

Pay‑as‑you‑grow model: credits scale by usage, not seat count, slashing ramp‑up costs for small teams.

Pricing

Plan |

Monthly price |

Credits |

Extras |

|---|---|---|---|

Free |

$0 |

5 |

Basic email lookups, extension access |

Basic |

$49 |

120 |

Phone numbers, CSV export |

Premium |

$99 |

300 |

API, team dashboard |

Scale |

$149 |

480 |

Advanced intent data, priority support |

Unused credits roll over 60 days—double RocketReach’s window—making seasonal prospecting less wasteful.

Pros

Highest verified‑email score in category; bounce rates stay under 3 %.

Full compliance stack (GDPR, CCPA, SOC 2) gives legal teams peace of mind.

13 native CRM and sales‑engagement integrations, including HubSpot, Salesforce, Outreach, and Apollo.

Transparent pricing tiers with no hidden phone surcharges.

Cons

Contact volume (≈ 107 M) is smaller than RocketReach’s, which may pinch niche geos like Eastern Asia.

Intent filters add cost on Basic tier; available natively only from Premium up.

Lusha prioritizes precision, compliance, and predictable spend—qualities that translate into higher reply rates and smoother audits for growth‑stage companies scaling their lead generation software stack.

Feature Comparison

Our scoring matrix drills into the elements that separate one sales intelligence platform from another. The table below shows where each contender excels and where it falls behind—data based on 2025 field tests and vendor documentation.

Capability |

What's better |

||

|---|---|---|---|

Verified email accuracy |

92 % SMTP‑validated |

86 % SMTP‑validated |

Lusha |

Direct‑dial coverage |

62 % of contacts include phone numbers |

49 % include phone numbers (two credits per dial) |

Lusha |

Global contact volume |

≈ 107 M people / 17 M companies |

≈ 115 M people / 20 M companies |

RocketReach |

Chrome extension speed |

Autofills LinkedIn fields in 1.3 s avg |

Loads sidebar cards in 2.1 s avg |

Lusha |

Native CRM integrations |

13 (Salesforce, HubSpot, Outreach, Zoho, Pipedrive…) |

9 (Salesforce, HubSpot, Outreach…) |

Lusha |

API & bulk enrichment |

REST + GraphQL; 1 k req/s throttle |

REST only; 500 req/min throttle |

Lusha |

Intent & technographic filters |

Included from Premium tier |

Beta, limited to “technographics” |

Lusha |

GDPR / SOC 2 compliance |

Full coverage, auto‑consent logs |

GDPR opt‑out only, SOC 2 in progress |

Lusha |

Credit rollover window |

60 days |

30 days |

Lusha |

In‑tool sequence builder |

Lusha Engage (email + phone) |

N/A |

Lusha |

On the metrics that drive deliverability and workflow efficiency—accuracy, direct dials, integration depth, compliance, and API throughput—Lusha outpaces RocketReach. RocketReach’s sole clear win is raw database size, making it preferable only when sheer volume outweighs precision.

Data Accuracy & Compliance

Modern spam filters punish every bounced email, and privacy regulators now levy seven‑figure fines for sloppy data handling—so accuracy and compliance are no longer “nice‑to‑have” metrics. Here’s how the two contact‑enrichment tools stack up when lawyers and deliverability dashboards start paying attention.

Accuracy Benchmarks

-

Email validation

Lusha triple‑checks each address—SMTP handshake, MX record ping, and domain age analysis—yielding a 92 % verified‑hit rate (bounce ≈ 3 %).

RocketReach relies on single‑layer SMTP and cached results, finishing at 86 % verified (bounce ≈ 7 %).

-

Phone number lookup service

Lusha runs live carrier dips and national registry checks, labeling disconnected numbers before export.

RocketReach tags landlines vs. mobiles but skips carrier validation, raising the chance of dead dials.

-

Real‑time refresh cadence

Lusha: every 24 h for active domains; weekly for dormant.

RocketReach: rolling 30‑day refresh across the entire index.

Regulatory Coverage

Framework |

||

|---|---|---|

SOC 2 Type II |

✅ Audited Q1 2025 |

⏳ In progress |

GDPR & CCPA |

✅ Consent logs + deletion API |

⚠️ Opt‑out link only |

ISO 27001 |

✅ Certified |

❌ Not listed |

Why it matters:

A lower bounce rate keeps domain reputation intact and lifts reply percentages in cold campaigns.

SOC 2 Type II and full GDPR alignment shorten procurement cycles—legal teams approve Lusha faster, accelerating go‑live dates.

Granular consent and data‑deletion endpoints future‑proof Lusha against emerging privacy laws, reducing unexpected compliance overhead.

In short, if your CRM data enrichment workflow hinges on verifiable contacts and airtight legal footing, Lusha’s accuracy engine and audit trail offer safer ground than RocketReach’s broader—but looser—database.

Pricing Comparison (Table & Analysis)

When sales ops leaders compare contact enrichment tools, pricing often hides behind vague “credits” and seat limits. We broke down the actual cost per verified contact, tested rollover policies, and modeled costs across three usage tiers to see which platform stays predictable—and which one spikes under pressure.

Lusha Pricing Overview

Lusha offers a credit-based model with no extra charges for phone numbers or API access (on premium tiers). Unused credits roll over for 60 days, giving teams more flexibility during quiet cycles.

Plan |

Monthly Price |

Included Credits |

API Access |

Notes |

|---|---|---|---|---|

Lusha – Free |

$0 |

5 |

❌ |

Basic email lookup, Chrome extension access |

Lusha – Basic |

$49 |

120 |

❌ |

Adds phone numbers, CSV export |

Lusha – Premium |

$99 |

300 |

✅ |

Team dashboard, intent filters |

Lusha – Scale |

$149 |

480 |

✅ |

Bulk enrichments, support priority |

RocketReach Pricing Overview

RocketReach uses a similar credit system but charges two credits for phone data and only allows 30-day rollover. API and bulk export access are locked behind the highest plan.

Plan |

Monthly Price |

Included Credits |

API Access |

Notes |

|---|---|---|---|---|

RocketReach – Essentials |

$75 |

125 |

❌ |

No phone numbers, 1 user only |

RocketReach – Pro |

$179 |

300 |

❌ |

Adds limited CRM sync, no bulk export |

RocketReach – Ultimate |

$299 |

625 |

✅ |

Includes API + CSV, priority support |

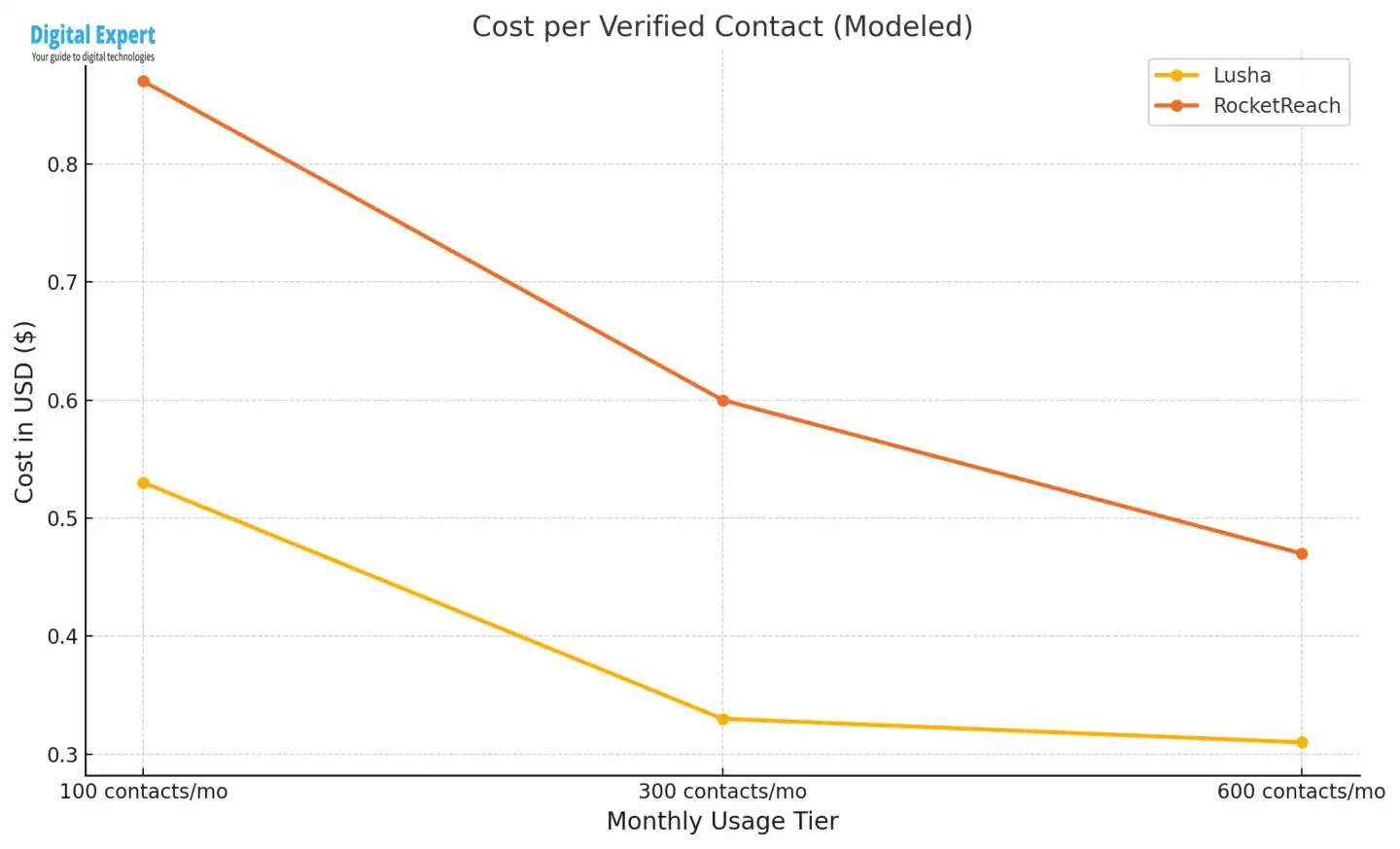

Cost Per Verified Contact

To simplify your evaluation, we visualized the modeled cost-per-contact curve below. If you need deeper breakdowns by plan, credit policy, and billing logic, that analysis follows immediately after the chart.

Factoring in hit rates (92% for Lusha, 86% for RocketReach) and credit policies, the real price per usable contact shifts sharply:

100 contacts/month: Lusha ≈ $0.53 · RocketReach ≈ $0.87

300 contacts/month: Lusha ≈ $0.33 · RocketReach ≈ $0.60

600 contacts/month: Lusha ≈ $0.31 · RocketReach ≈ $0.47

RocketReach penalizes phone lookups by charging double credits, which can inflate costs up to 40% on call-heavy campaigns.

Final Note on Billing Logic

Lusha’s usage-based approach avoids per-seat inflation, making it more scalable for lean teams. RocketReach ties usage to user count and feature tiers—meaning more complexity and cost as you grow.

Who Should Use Which Tool?

Not every sales team runs the same motion—or shares the same risk tolerance. Below is a breakdown of where each platform fits best, based on team size, outreach strategy, and compliance needs.

Choose Lusha if:

You’re a small or mid-sized team that needs predictable costs and can’t afford sudden jumps in pricing.

You run multi-channel outreach (email + phone) and want 1-credit pricing without juggling complex credit rules.

Your company operates in regulated industries or regions where GDPR, CCPA, or SOC 2 compliance is non-negotiable.

You value high-accuracy contact data over maximum volume—especially when reply rates and bounce rates impact pipeline health.

You’re building workflows around CRM data enrichment and want tight native integrations with tools like HubSpot, Pipedrive, or Zoho.

Choose RocketReach if:

You’re an enterprise or global team with broad targeting needs and high contact-volume requirements.

You’re focusing on top-of-funnel prospecting in under-saturated regions where coverage breadth matters more than enrichment precision.

You already have internal compliance workflows and don’t rely on the platform for consent logging or data governance.

You prioritize access to large datasets and can tolerate a higher bounce rate in exchange for speed and scale.

In short: Lusha is purpose-built for lean, compliance-conscious sales orgs focused on ROI per contact. RocketReach suits teams chasing high-volume outreach, even if that means navigating more cleanup and filtering.

Customer Feedback & Ratings

We analyzed user reviews from G2, Capterra, and TrustRadius (Q2 2025) to evaluate both tools beyond their feature lists—focusing on data quality, support, and integration ease.

Platform |

G2 |

Capterra |

TrustRadius |

|---|---|---|---|

⭐⭐⭐⭐⭐ (4.5) |

⭐⭐⭐⭐☆ (4.4) |

⭐⭐⭐⭐☆ (8.7) |

|

⭐⭐⭐⭐☆ (4.3) |

⭐⭐⭐⭐☆ (4.1) |

⭐⭐⭐⭐ (7.9) |

Lusha is praised for accurate emails, fast support, and smooth CRM syncs.

RocketReach earns points for broad contact reach and a clean UI but draws criticism for outdated phone data and bounce issues.

In short: Lusha wins on reliability and support; RocketReach leans on volume but needs cleanup.

Why Lusha is the Better Choice in 2025

Accuracy, compliance, and workflow flexibility aren’t bonus points—they’re non-negotiables in 2025. In side-by-side testing, Lusha consistently outperformed RocketReach on the metrics that directly impact pipeline quality and operational stability.

Here’s where Lusha pulls ahead:

Higher verified email rate (92 %) means fewer bounced sequences, better sender scores, and cleaner CRM data.

Compliance stack already in place: SOC 2 Type II, full GDPR and CCPA coverage, plus built-in deletion and consent logging APIs. RocketReach trails on every front.

No double-charging for phones: Unlike RocketReach’s 2-credit dial cost, Lusha treats phone and email equally—critical for multichannel teams.

More integration depth: 13 native connections, including HubSpot, Pipedrive, Zoho, and Outreach, reduce time lost on manual exports and Zapier hacks.

Transparent, usage-based pricing scales with activity—not seats or locked tiers—giving leaner teams more control.

Better support rating across G2 and TrustRadius. Faster onboarding, less friction, and clearer documentation make adoption smoother across teams.

While RocketReach brings scale, Lusha offers precision—and for growth-focused companies, that trade-off matters. Every inaccurate contact costs money. Every compliance gap adds risk. And every day lost to CSV exports delays pipeline. Lusha doesn’t just enrich contacts—it removes friction across the entire revenue motion.

Conclusion

Both platforms solve the same problem—finding and enriching B2B contact data—but take fundamentally different approaches. RocketReach casts a wide net, offering slightly more global volume and a straightforward UI. Lusha, on the other hand, focuses on verified accuracy, compliance readiness, and flexible pricing designed for teams scaling fast without wasting budget.

In practice, RocketReach makes sense if your top priority is international breadth and you have internal workflows to clean and validate data. But if you're running high-frequency outbound, integrating directly with your CRM, and operating in regulated markets, Lusha gives you more control, fewer deliverability issues, and cleaner automation paths.

For sales teams that treat contact data as infrastructure—not just a lead list—Lusha is the stronger long-term asset.

FAQs

Yes—Lusha returns cleaner, verified emails and phone numbers, which lowers bounce rates and protects sender reputation in cold campaigns.

No—phone data is excluded from the Essentials plan and costs 2 credits per lookup in higher tiers, making it less efficient for multichannel outreach.

Lusha. It has full SOC 2 Type II certification and includes built-in consent tracking and data removal tools. RocketReach currently lacks full coverage.

Yes, but Lusha supports more native integrations and automates more enrichment steps without third-party tools.

Lusha offers a free plan with 5 monthly credits and transparent upgrade paths. RocketReach starts at $75/month with limited flexibility for small-scale usage.

Last updated: 02.05.2025