Increasing your global workforce through an Employer of Record Risks can have access to the best international human resource without establishing foreign entities. Theoretically, an EOR will take charge of payroll, benefits, and social insurance among other obligations, so that you do not need your HR to do that. Practically, Employer of Record compliance model has critical risks associated with it. These will be the employee misclassification, liability to joint-employment, payroll and tax mistakes, various add-ons, and violations to local labor laws.

Of course, such a misclassification may be present even between 30 percent of employers in the U.S. Misclassification may lead to fine (3 percent of wages, 100 percent unpaid FICA and 40 percent FICA penalties per employee) and even lawsuit of class action.These tips divide large EOR risks damaging fines, co employment liabilities, pay Roland misfortunes, and employment agreement misfortunes, and demonstrates how to handle them.

Our comparison is between EOR vs. PEO (Professional Employer Organization risks), as well as risk-benefit table, and also FAQ section of important questions when hiring. On the way, we will also point out mitigating risks with the help of such tools as the compliance checklist and international labor hire packages offered by Deel and examine some factors that should be considered.

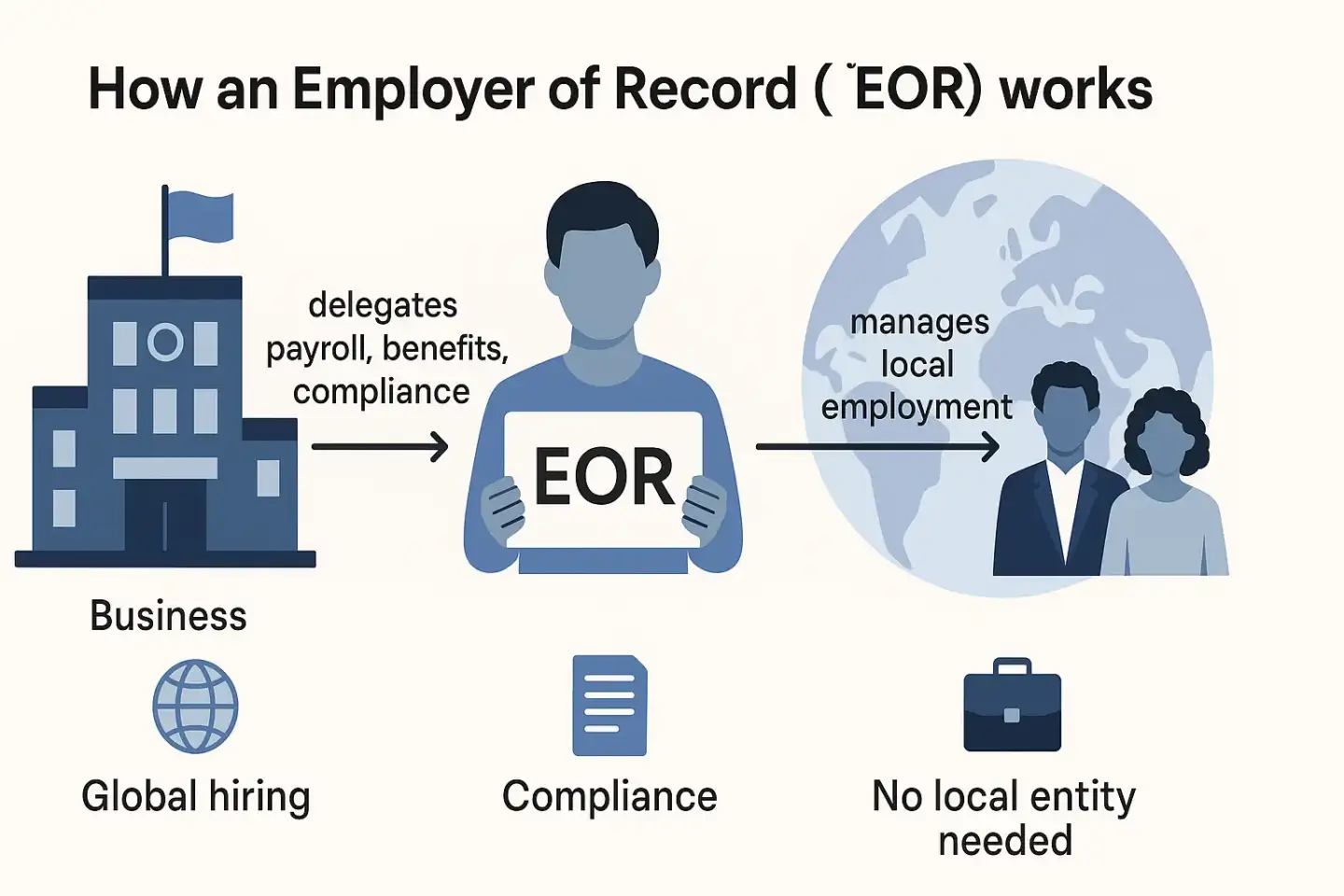

What Is an Employer of Record?

The third-party risk is called the Employer of Record Risks and gives you the outsourced employer of your new-place hires. In this scheme, the EOR takes up payroll, tax deduction, benefits pay (health insurance, retirement, etc.) and local employment laws. That is to say, Employer of Record will assume the legal status of your workers as an employer in terms of paying your staff, taxes, compliance, and other human resource related processes.

This will enable your company to get access to international labor “across the globe, simplify the management process and reduce the international HR headaches pertaining to compliance”.Advantages: EORs make expansion to new global markets fast, convenient, and cheaper without having to setup entities. They are also able to provide compliant benefits package and eliminate the errors of classification and tend to liberate your HR staff to concentrate on the main strategy.

Warning: EORs, even though they bring these benefits, do not have all the risk eliminated. Active employee risk management is the most appropriate way through which your company can deal with these risks. Improperly selected or handled EOR workings may cause accountability and fines. Speaking about top EOR risks, what are they and how can we consider them in detail?

Key Employer of Record Risks

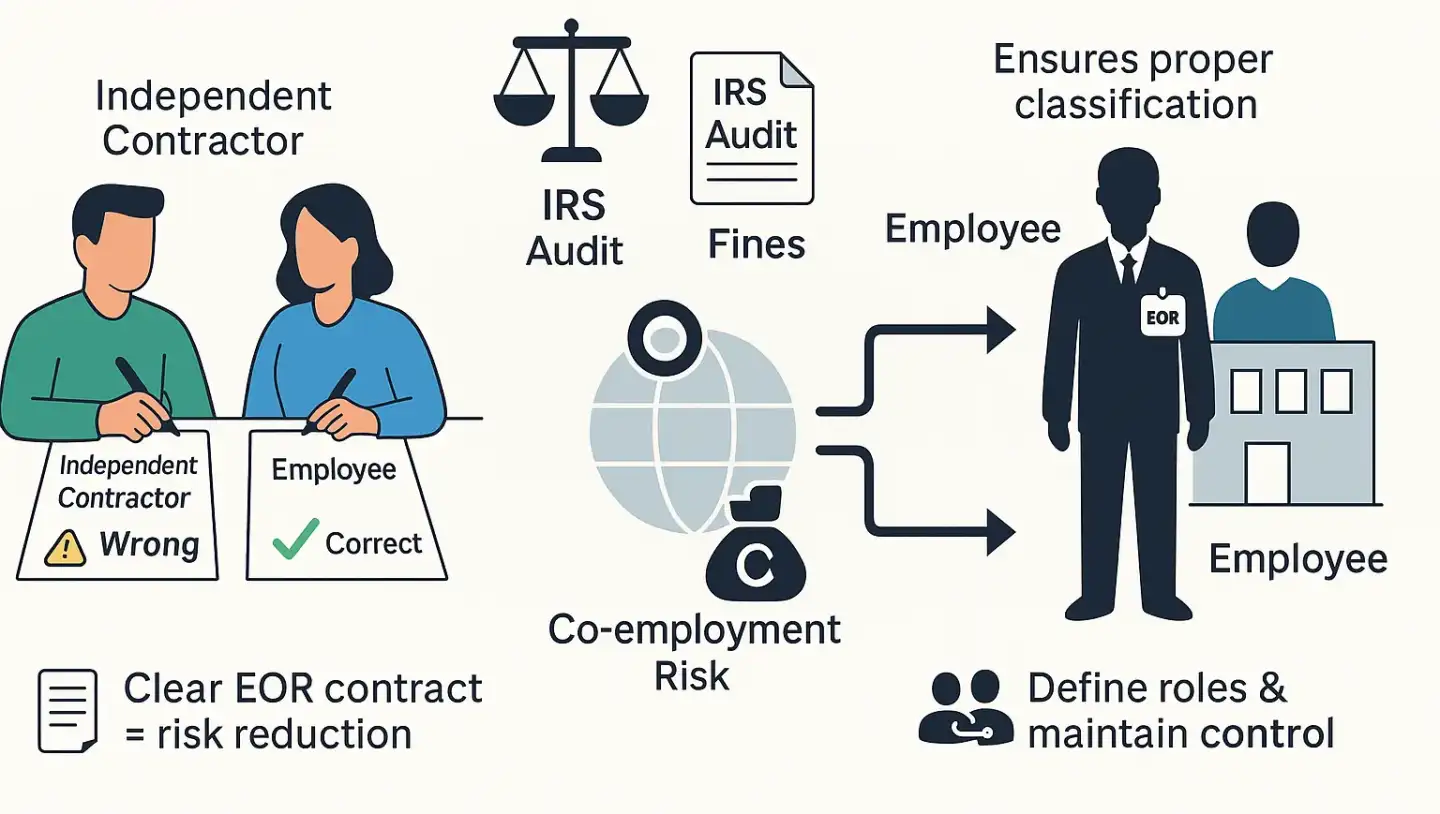

Misclassification and Co-Employment Liability

Employee misclassification is one of the greatest hazards of hiring in the global arena. Companies may end up into serious legal and monetary problems due to ignorance of employment classification, without the knowledge that a worker has been classified as an independent contractor when in reality he or she is an employee. Misclassification is the most widely occurring labor violation in the U.S., which sometimes leads to IRS audits, back wages, and interest as well as fines of up to 3 percent of wages and even imprisonment.

Each incorrect hire can not only subject a company to class-action lawsuits and liability in the millions of dollars but so can a good intent misclassification.A skilled Employer of Record (EOR) can provide a solution to this risk because it can expect that it appropriately classifies workers and compensates them according to local laws. The use of EORs structures does however create joint-employment risk, i.e. the EOR and the client company are both classed as legal employers.

The U.S. courts usually conduct their evaluation of the control the client has over the employee, which subsequently may lead to liability of labor violations. This is the reason why it is important to write a well-defined EOR agreement in which responsibilities concerning the subject matter are defined and the responsibility assigned. It is important to monitor a properly written contract in order to reduce the risk of co-employment. In brief, follow the EOR during the classification knowledge but keep the control and straightforward contracts.

Local Labor Law Non-Compliance

The practice of employment laws differs highly among countries — even states. This may soon turn out to be expensive upon failing to comply with local regulations. As an example, the company of United States (U.S.) with an EOR in France was heavily fined to break the 35-hour workweek by paying a 25 percent overtime premium and combating labor disputes. The threat of the overtime and breaks laws is also strongly present in California.

Other data privacy regulations such as the GDPR and the California Privacy Act are even more serious with a penalty of €20 million or 4 percent of worldwide revenues on violations. Due to such complexities, compliance must be put up all the time. A trusty EOR ought to monitor the changes in local labor laws, adjust the contracts and alert the risks involved. There will still be the possibility of lawsuits or fines even though the EOR did the wrong thing or your in-house staff did the wrong thing.

As an example, Irish employees may be who will be re-categorized to be agency employees, or the Canadian or Australian courts may find your company to be responsible in as far as the EOR options are concerned. It is therefore important to screen EOR partners. Make sure that they are well educated in the legal field, knowing the local area, and possess certification, such as SOC 2 or ISO 27001. Common audit practice and communication are the most significant to remain compliant in different jurisdictions.

Looking for more tools like HR platforms?

Check out the 👉best hr platforms👈 — find the perfect planner for your business!

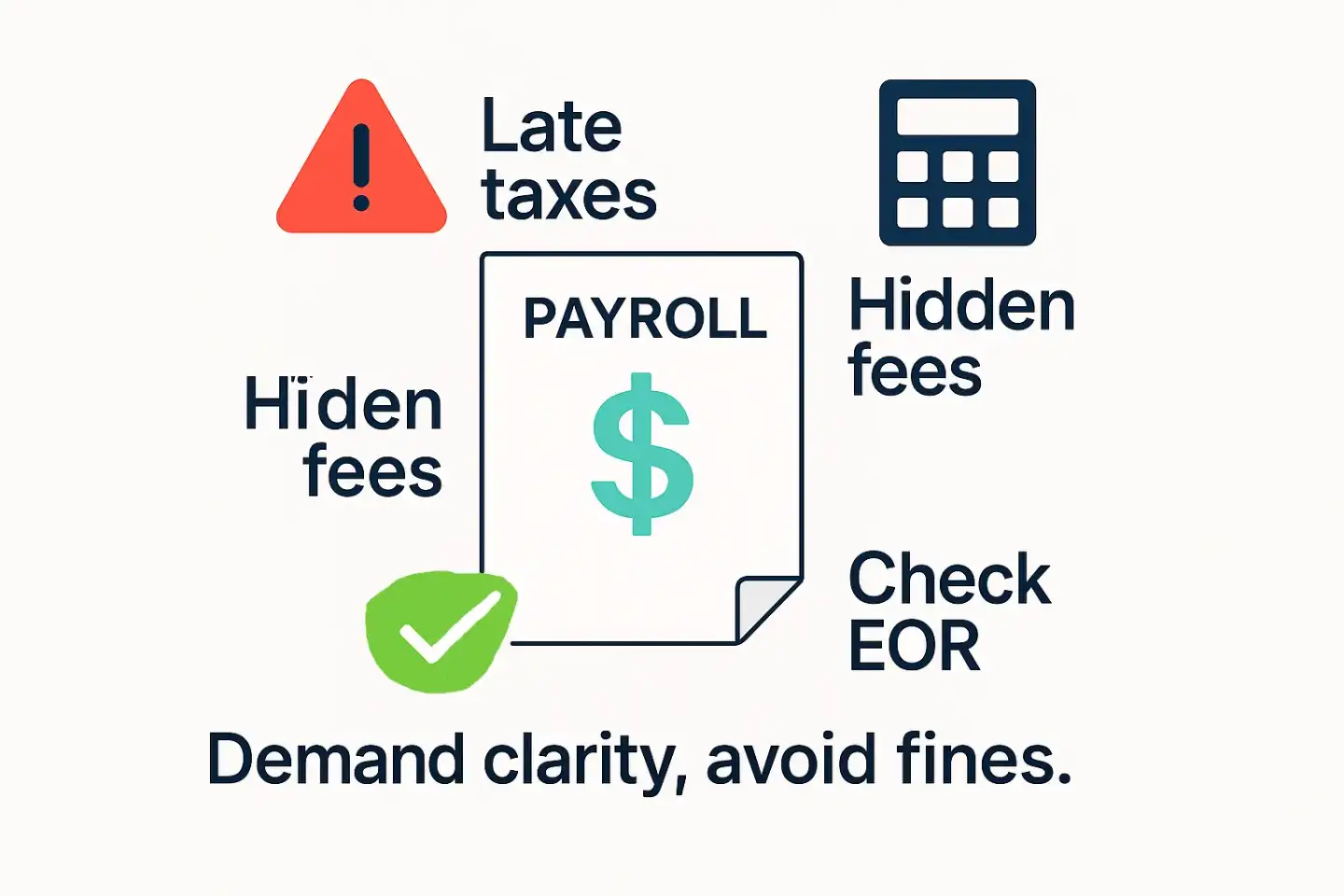

Payroll, Tax and Financial Errors

International payroll management is difficult and apt to be pricey. Underpaying and overpaying payroll taxes and failure to meet deadlines all have the potential of the tax administration fining, levying interest, and conducting audits on government agencies. An EOR may come in to be the main employer during the taxation process, computation of rates, timely filing, and copes with the changing tax regulations. This centralization sets aside risk, and hence the businesses do not get fines due to non-compliances or long outdated practices. Nevertheless, it all comes down to responsibilities as to whether the EOR does its job responsibly and clearly spells out duties.

Nevertheless, there lie risks. Onboarding, benefits or severance packaging fees are often hidden by some EORs. Currency variance may also increase the expenditure as far as paying the foreign employees in their currencies. Missed pensions or insurance are not the only mandatory contributions one might forget about in his or her quote and generate an unpleasant surprise of unexpected expenses or even become legally vulnerable. Every U.S. state has its payroll requirements, with missing forms and filing in incorrect jurisdiction bringing fines in with them. To remain secure, ensure the EOR is duly registered, demand a clear repackaging of all the expenses and carry out frequent checks to confirm they are compliant.

Hidden Costs and Contractual Pitfalls

Services of EOR are not free. They usually get a platform fee with a monthly fee per employee and possibly a passing through costs of a mandatory benefit. There might be exiting costs such as the severance pay or termination costs.

The cost is one of the drawbacks as EORs may be more costly than they were expected in case when the number of the employees is large; sometimes it may be cheaper in the long run to have a local subsidiary. Request quotations of several EORs and discuss a budget situation regarding an entity establishment fee in contrast to a long-term fee.

Contract-particulars are important. These are red flags you should watch out of in Employer of Record agreement:

Vague Lines of Liability: Be certain that the phrase in the contract lays out the liability of each party. Do not make any waiver that will subject your company to risks of being subjected to tax or labor violations.

Absence of Local Entity: In the case that the provider is an aggregator (and does not provide its own legal entity, but relies on partner companies elsewhere) make it clear who is the legal employer and what about resolving disputes.

Sacking Conditions: Make sure there is no unreasonable notice or termination fee. Find out the transfer of records of the employees and taxes in case you want to change providers.

Insurance: Does the EOR have workers compensation, professional liability or errors and Omissions insurance? Otherwise, you may consider going out and demanding evidence or securing your self insurance in the event of claims.

Data Security obligations: The Employer of Record will process sensitive data of employees. Give it the certification that it adheres to the GDPR/CCPA. The breach of data entails fines that can be in the form of huge fines, millions or part of your turnover.

Laxity in this aspect can turn out to be a nightmare in terms of compliance. The sensible thing to do would be to approach this contract similarly to any other large vendor deal: engage the lawyer and the HR department, do a terms benchmark and demand transparency. Keep in mind: not only a black-box vendor Employer of Record will be like a partner to you. When the provider is ambiguous or silent, that should raise the eyebrows.

Employee Relations and Cultural Risks

It is a danger that is usually not considered, which is employee morale and organizational culture. Since the employees under EOR employment agreement do not come under your business but, signed their agreement with the EOR, they might feel distant. They may associate with the local EOR organization or perceive themselves as short-term contractors instead of the whole team members.

This is capable of causing turnover: as one of the founders reported, early EOR hires could “get the feeling that they worked maybe more on their own and were working maybe even more on the EOR” so his team has added the additional onboarding and team-building to counter it.

To counter this, engage remote workforce or overseas staff: initiate frequent virtual interactions, communicate with them on company-wide basis as well as provide the same culture/performance support that other employees get. It should also be kept in mind that the EOR model is a rather different staffing agency: an agency does not employ its workers but an EOR does employ and gives the workers all the benefits and protections. The boss should focus on communicating to the workers that they are legally hired and they enjoy good packages.

Business Continuity Risk

What happens when your EOR partner miscarries either through bankruptcies, takeover or litigations? The performance of your payments as well as your conformity with the same vendor. When they cause a disruption of the services, your employees may fail to get a pay or your legal filing may not reach the expiry time. This would be particularly dangerous, in case the EOR is an aggregator; changing the local provider would prove a complex task. The measures to mitigate are:

Vet in the financial good: Select an organization that has been in operation (such as Deel, Globalization Partners, etc.) for more than a couple of years and has good reviews.

Backup plans: Question the EOR what he/she would do in case of a transition (some aggregators will guarantee a sort of a swap out arrangement).

Contractual Protection: The contract should contain the requirement that the EOR should provide notice of transfer of ownership or loss of accreditation beforehand, and the terms to facilitate handover of the employee data.

Preventing a network hiccup is impossible but the preventions can make it doable.

Comparing EOR vs. PEO: Risk Table

The way risks vary in an Employer of Record and in a Professional Employer Organization (PEO) is outlined below. A PEO not only does payroll, benefits, but only in those jurisdictions where you already have established a legal entity (and it is co-employment mode all the time).EOR vs PEO: key differences at a glance

Factor |

EOR (Employer of Record) |

Professional Employer Organization or PEO |

|---|---|---|

Legal liability |

EOR as a full his person employer accepts the compliance risks and hedges your company against them. |

Co-employment model the legal responsibility still lies on your company. |

Compliance reach |

Operates in many places even in those which you do not have an established entity. |

Only works in the country, in which your firm is already registered. |

Tax & payroll |

Processes international filing and payment submission, and when something goes wrong, it is the fault of EOR. |

Shared liability: your firm can remain liable of the tax errors. |

Worker status |

Minimizers misclassification risk- EOR also is the legal employer. |

Even supplies structure, however, co-employment could be subject to questioning. |

HR control |

You cede some of the control to EOR: it operates HR on a day-to-day basis. |

It maintains greater control on your hands of course HR decisions could remain in-house. |

Pricing |

Fixed per-employee charges-very good to be used globally, although they are expensive on a per-head basis. |

Fees in the form of percentage of payroll-very economical when it comes to dealing with big local teams. |

Team culture |

The employees will feel estranged to your brand-it is the EOR that they encounter. |

The co-employment retains more employees closer to your organizational culture. |

In summary, EORs practically pass all regulatory risks to the provider when extending to an overseas destination but reduce in-house risk levels at the same time, PEOs pass minimal risk levels in-house but demand an existing local company. Select a model of your choice: a PEO is the right model to use when you want to grow domestically, and an EOR to expand into other markets.

Off-topic: if you’d like to see which matters more — 👉DA vs DR👈 — check out our comparison on the site.

Risk Benifit analysis Matrix

Table of trade-offs, benefits, mitigation measures between EOR risks and benefits can be observed below:

Aspect |

Benefit |

Risk |

Mitigation |

|---|---|---|---|

Compliance |

Makes sure that its operations are legal in foreign countries |

Exposure to law in case of failure by EOR |

Check the record of Vet EOR; audit filing; compliance checklist |

Classification |

Transparency of employee state |

Legal risk of joint-employment |

Include terms of indemnity; check out roles; take legal opinion |

Hiring speed |

Fast start-up in the market |

Less control over enforcement of policies |

Define processes early; maintain strong communication |

Cost |

Cheaper than opening entity; benefit deals |

Hidden fees; currency risks |

Compare total cost; cap fees; lock rates |

Employee experience |

Good incentives increase retention |

Sense of alienation to the firm |

Onboarding: inclusive; training in terms of culture |

Data security |

Authorised payroll systems (e.g. SOC 2, ISO) |

Increased breach risk; increased compliance risk |

Demand of audit; have security provisions; have encryption |

Legal liability |

EOR presupposes the employment responsibility under the law |

Contracts with a vague language are legally counterproductive |

Evaluation of contract by law; a definition of roles and responsibilities and liability; |

This matrix can help you to balance out risks vs. rewards of my EOR model. Overall, EORs decrease that of your exposure in the compliance of foreign but demand a careful supervision in governance and culture.

How to Mitigate Employer of Record Risks Liability

To minimize the risks of EOR considerably, it is possible to apply the best practices:

Due Diligence: Analyse the reputation, local experience and the structure of the EOR. Enquire whether they work as an aggregator or have their entities in target countries. Ensure that they have the necessary licenses (employment agency licenses when they are dealing with any).

Good Contracts: Bargain on the plain words. Indicate who is responsible to what risks, in case of the wrong classification or the incorrect imposition of taxes, set out termination and hand over details, and insist the EOR must make available the necessary insurance and auditing.

Continuous Communication: Have open contacts with the EOR. Consider checking payroll reports, timesheet and compliance benefits enrollments of the employees on a regular basis. Develop a ladder of compliance on any matter concerning the line of work.

Apply Checklists and Tools: Make use of an Employer of Record Risks compliances checklist to monitor requirements. As an example, the Global Payroll Compliance Checklist created by Deel supports the correct classification of workers, the legality of deductions to payroll, and data protection. Look at the Additional Resources below.

Local Advice: Keep your own local lawyers or advisers on key countries. They will be able to inform them about the peculiarities of contracts (e.g. the obligatory notice periods in Europe) and raise alarm (or "EOR agreement red flags") about the absence of statutory terms.

Insurance & Audits: Said EOR must have workers comp and cases of malpractice covers. Carry out financial and legal audits on their filings now and then so as to keep them in position.

Exit Planning: Consider to have an exit plan in your contract. What if you end up getting fired or terminated? Then data portability must include the passing of employee records, payroll history and benefits safely to another provider or back in your hands with ease.

There are ways to eliminate employer of record risks liability by taking several steps, some of which even intersect with a checklist of Employer of record Risks compliance. In this way, companies can take advantage of the opportunity to start hiring worldwide and operate at a global level without any fear of losing the liability case.

Conclusion

International employee hiring using an Employer of Record risks has the potential to open up some potent advantages: the quick penetration into international markets, global access to top talent, and an easier administrative HR. However, it also brings in the element of risks in complying, exposure, and expenses. The companies can enjoy the benefits of EORs without putting their businesses at risk by learning about the potential risks of using EORs (misclassification, co-employment, payroll errors, and so on), and taking exceptional precautions.

Pay attention to a due diligence, call the contracts to be transparent, and keep control over payroll and benefits.In case you are seeking the most recent compliance assistance, take a look at what Deel suggests. Deel provides all-encompassing solutions extended in the form of such tools as Global Payroll Compliance Checklist or Employer of Record Risks Guide to allow HR departments to audit their procedures and remain compliant with the legislation in a particular country. All this coupled with guides and a reliable EOR partner, your organization should be able to reduce the EOR risk and water to concentrate on strategic growth.

Call to Action: Do not forget to read through Deel Global Payroll Compliance Checklist and Global Hiring Guide (includes information about working with EORs) to ensure your international hiring becomes legally compliant and stress-free. These tools offer decision-by-decision procedures of conducting payroll, categorizing employees, and complying with the law in 150+ countries — a memory jolt to safeguard your global workforce even in 2025 and beyond.

You can find even more comparisons and alternatives to very good tools 👉on our blog👈

FAQ

The main risks associated with using an employer of record benefits include potential compliance issues, misclassification of employees, and limited control over workforce management. Additionally, analyzing companies may face financial liabilities if the EOR fails to meet legal requirements, emphasizing the need for thorough due diligence before partnering with one.

In the U.S itself, EORs are risky. The most crucial ones are misclassification (contravening the Fair Labor Standards Act, FLSA), payroll tax issues, and other parts of the job with the laws of the states (such as overtime regulations or paid leaves policies). To give an example, refusal of overtime causes back wages and penalties to be initiated. In addition, the payroll taxes (SDI, SUI, and taxes by the local cities, etc.) vary in the different states. In order to cope with this, it is preferable to select the EOR who knows the federal and state requirements of the U.S. and check the accuracy of timesheets/payroll.

Demand a contract that spells it out in a clear manner in regard to performances in the matter. To begin with, make the Employer of Record the legal employer of record risks (thereby they take employment liability as a result). Add indemnity: any penalties arising out of the mistakes of the EOR should be met by the EOR. Insure that they maintain adequate insurances (tax E&O, workers comp) and give audit rights. Then, it is important to use the reliable EOR platforms (such as Deel) that invest in the legal support and global compliance tools, and this move also helps to shift responsibility off your company.

Among all, a checklist should consider the following points to be covered: (1) legal entities or partners in each country where hiring employment risks; (2) registered in all the necessary taxes and social contributions; (3) payroll and benefits are calculated as prescribed by local laws; (4) mandatory benefits (such as health insurance, pension, and paid leave) are included in the service; (5) pays work and rest, holidays, and other activities as per labor regulations; (6) mandatory insurances are maintained; (7) protects employment risk data (GDPR/CCPA compliance); and (8 Such checklists are offered by the resources of Deel (see the Global Payroll Compliance Checklist).

Such red flags entail: Unclear liability terms, lack of a clear governing law, unclear termination agreements or terms, or auto-renewal with no limit to time. You should also look out on an EOR that would not disclose its local entity(ies) or would not want to disclose sub-contractors. Insufficient commitment to or disclosure of data security is an issue of concern. In case of unclarity of the fee structure (e.g. unclear platform fees or high cost of terminating the contract), pester further. Briefly speaking, any ambiguity in language as far as who bears the ultimate responsibility as far as taxes, benefits and terminations are concerned is not good news.

The PEO offers co-employment in jurisdiction where an entity already exists. Nevertheless, you remain liable to the PEO because the two names will be appearing in the documents. In a contrast, an EOR would be the only legal employer of record risks (on paper) based in countries where you do not have an existence. This implies that the EOR accepts complete responsibility on issues of compliance. The danger of having an EOR is that your company gives up a lot of direct control but with a PEO you maintain more control albeit with legal liability as well.

Those payments are to be remitted by the Employer of Record risks (as it is considered to be an official employer). This is however not guaranteed as there are specific jurisdictions that the final liability could be unwound back to the client company when they fail. That is why, it is important to select stable EOR. Other firms are contracting certain guarantees, The EOR is obliged to rectify the default payments or have an insurance covering against the lapses. The best practice is also to check once in a while that all the payroll taxes and contributions were actually reported.

Potentially, yes. In case your workers (using the EOR) begin completing tasks that form a fundamental part of your business, certain taxation agencies may claim that you have established a local permanent establishment and expose your company to domestic corporate taxes. It is a tricky field- refer to tax professionals. In a lot of EOR arrangements this is a low risk (because technically such staff are on the payroll of the EOR), but it depends on local laws.

Services offered by EOR are particularly desirable by small-to-medium corporations that have interest in employing a small group of foreign employees without incurring the expenses of legal entity. They normally prove more economical than entity formation in less than 20 employees. The bigger companies could also deploy EORs in the case of an interim project or in the country that they could have no entity. In any case, smaller or bigger, the question is whether the guarantees of its compliance can suit you.