We test and review software products using an independent, multipoint methodology. If you purchase something through our links, we may earn a commission. Read about our editorial process.

Payroll software is very important for any small business payroll that works in the United States. It does more than just pay employees; it provides peace of mind knowing that the right payroll management software, known for its ease of use, helps a business keep up with payroll taxes, tax regulations and local tax laws compliance, gives correct payroll data reports, generates customizable payroll reports, sorts employees the right way, and helps with a wide range of benefits administration. Now, many companies in the U.S. deal with remote teams across various time zones, have lots of contractors, and work in more than one state. Because of this, the right payroll software needs to do much more than only crunch numbers. It helps people get paid right and makes sure the business follows all the rules.

This guide looks at the best payroll software you can use in the U.S. in 2026. It talks about the best platforms to help large enterprises manage their payment schedules and make payroll tasks simple, including options for paper checks, keep your business in line with the rules, and give you an easy time. In this guide, we review Papaya Global, Sage Payroll, Deel, Buddy Punch, KiwiHR, Oyster, Netchex, and Remote Payroll. Each of these payroll software tools works for different types of business needs, so you can find one that fits you.

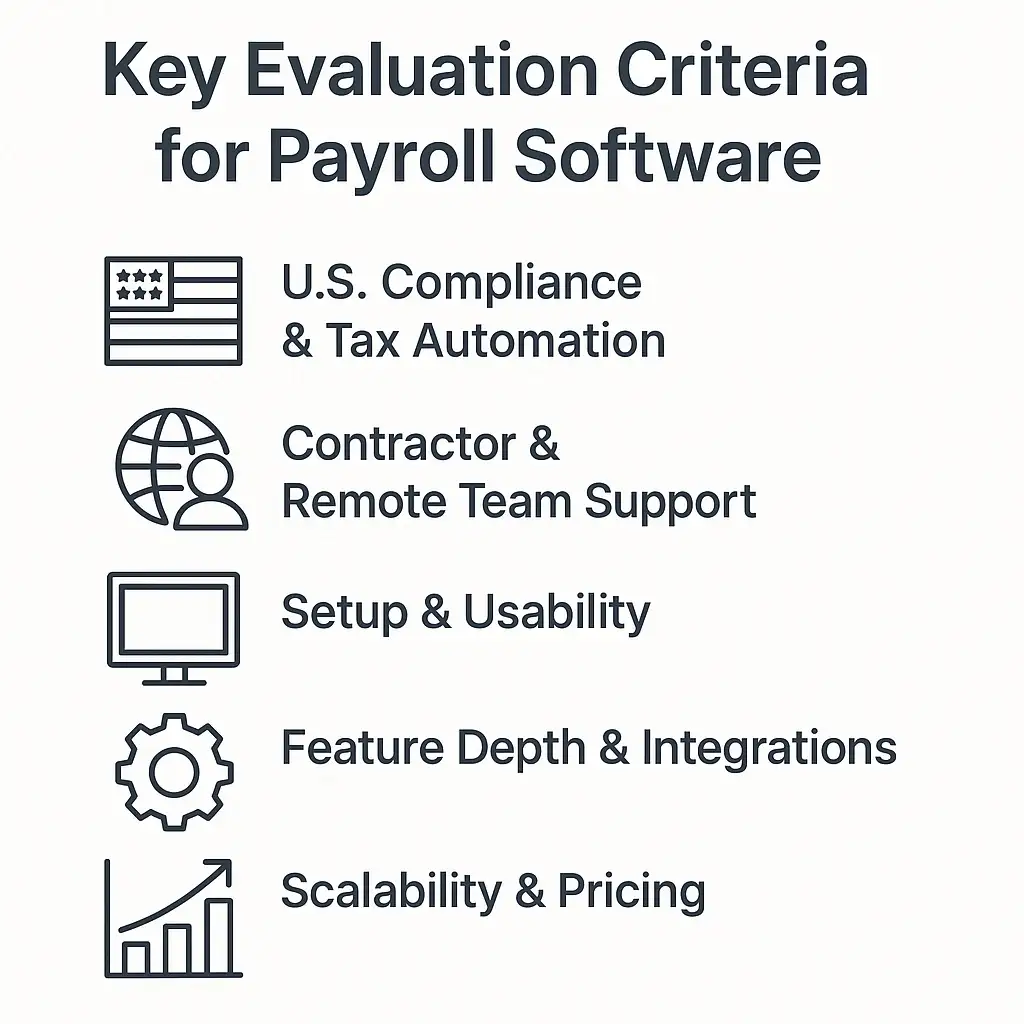

To find the best payroll software for businesses in the U.S., we use our own way of looking at things. We mix the technical side with what users want and need, including effective customer support. Our method checks several key areas:

We analyze how each tool handles:

Federal and state tax filings, like W‑2s, 1099s, 941s, and more

Automated deductions as well as wage garnishments

ACA reporting, plus checking benefits eligibility

Does the platform support:

Contractor onboarding is done with the right classification each time.

Global-to-U.S. changes are smooth with EOR help.

Taxes for workers in more than one state are handled.

We test:

Onboarding speed for new businesses

Dashboard intuitiveness

Availability of live chat/help center and human support

We measure:

The platform gives you many ways to see and use reports and analytics. You can look up things in the system and get a good idea of what is going on at work.

There are tools included to track time, handle PTO, and make schedules. You do not need to use other software for these tasks.

The system works with HRIS, accounting like QuickBooks, and ATS platforms. This lets all your data come together in one place.

We assess:

You get clear and transparent pricing models that are based on the number of workers or contractors you have.

It will be easy for the company to grow because it lets you scale your team, whether you are working across different states or even in other countries.

There are flexible plans that are good for startups and teams that are growing.

Unlike global payroll systems that mainly deal with changing money and global banks, U.S. payroll needs a deeper look at rules in each state.

Tax difference between states: There are changes in unemployment insurance, income tax brackets, and SUI or SUTA taxes in different states.

Filing jobs: You have to make W-2 and 1099 forms. You need to file them online with the IRS and local groups.

Healthcare rules: You must do ACA reporting. You also need to handle benefits payments and COBRA.

That is why you need to pick platforms that work well in the U.S. or are made for people all over the world but still have strong U.S. options. This will help you get the most out of their features and make sure your needs are met.

G-P offers a reliable global employment and payroll solution with robust support for U.S. operations. The platform manages local tax compliance, benefits administration, and automated payroll processing, ensuring teams get paid accurately and on time. With built-in tools for handling W-2s, 1099s, and multi-state regulations, G-P simplifies hiring and paying employees in the U.S. while staying fully compliant.

Best for: Global companies expanding into the U.S. that want a compliant, all-in-one payroll and employment solution.

Papaya gives people a strong global EOR and payroll system. The platform has a special module for U.S. compliance. It can automate tax filing, send out W‑2/1099 forms, and track time. This makes it very good for multinational companies that have staff in the U.S.

Best for: Companies around the world that want to set up local payroll in the U.S.

Sage gives you strong U.S. payroll tools with their accounting products. The software lets you use direct deposit, handle wage garnishments, and track PTO. You also get full tax automation.

Best for: This is good for U.S. companies that are already set up and need to connect their accounting and payroll together.

Deel started by helping with global contractor payments. Now, the company also offers full payroll services for international employees and U.S. employees through leading global payroll providers. You get support for benefits, exceptional customer service checks for rules, help with onboarding, and payroll in many states.

Best for: Startups that have both contractors and full-time staff in the U.S.

A time-tracking tool that now helps with payroll. It works out hours and overtime to give payroll-ready details. You can then send this data to payroll processors.

Best for: This is good if you run a business that pays people by the hour. It makes it easy to keep track of the time and move that info right into your payroll system.

This HR software solution helps you run payroll easily and offers a range of HR tools, including comprehensive human capital management (HCM) solutions, retirement solutions, and HR solutions for retirement plans, making it a comprehensive HR management solution that emphasizes employee management and improves the seamless payroll processing. It can make pay runs, keep track of leave, and give out simple tax forms. It is best for smaller teams that want an easy way to manage these things.

Best for: Small businesses that want a simple way to handle both payroll and HR in one place.

Oyster’s EOR platform, an employer of record solution, lets companies hire and pay people in the U.S. even if they do not have a U.S. office. It takes care of things like following the rules, benefits, and other important work for you.

Best for: Global companies that want to hire in the U.S. but do not have a local company there.

A U.S.-only payroll and HR platform that gives you strong reporting, follows the rules, and has local support. It helps with ACA, paid time off, starting new hires, and more.

Best for: Midsize businesses that need strong help with payroll and HR in the country.

Remote’s U.S. payroll module lets you pay both contractors, remote workers, remote employees, and international teams of employees across different currencies. It also handles automated tax compliance and manages benefits, providing mobile access via a mobile app for added convenience, making it an excellent option as a global employment platform to grow your team. This tool is a good choice if you want to grow your team.

Best for tech businesses that want to grow their teams in the U.S. and in other countries, too.

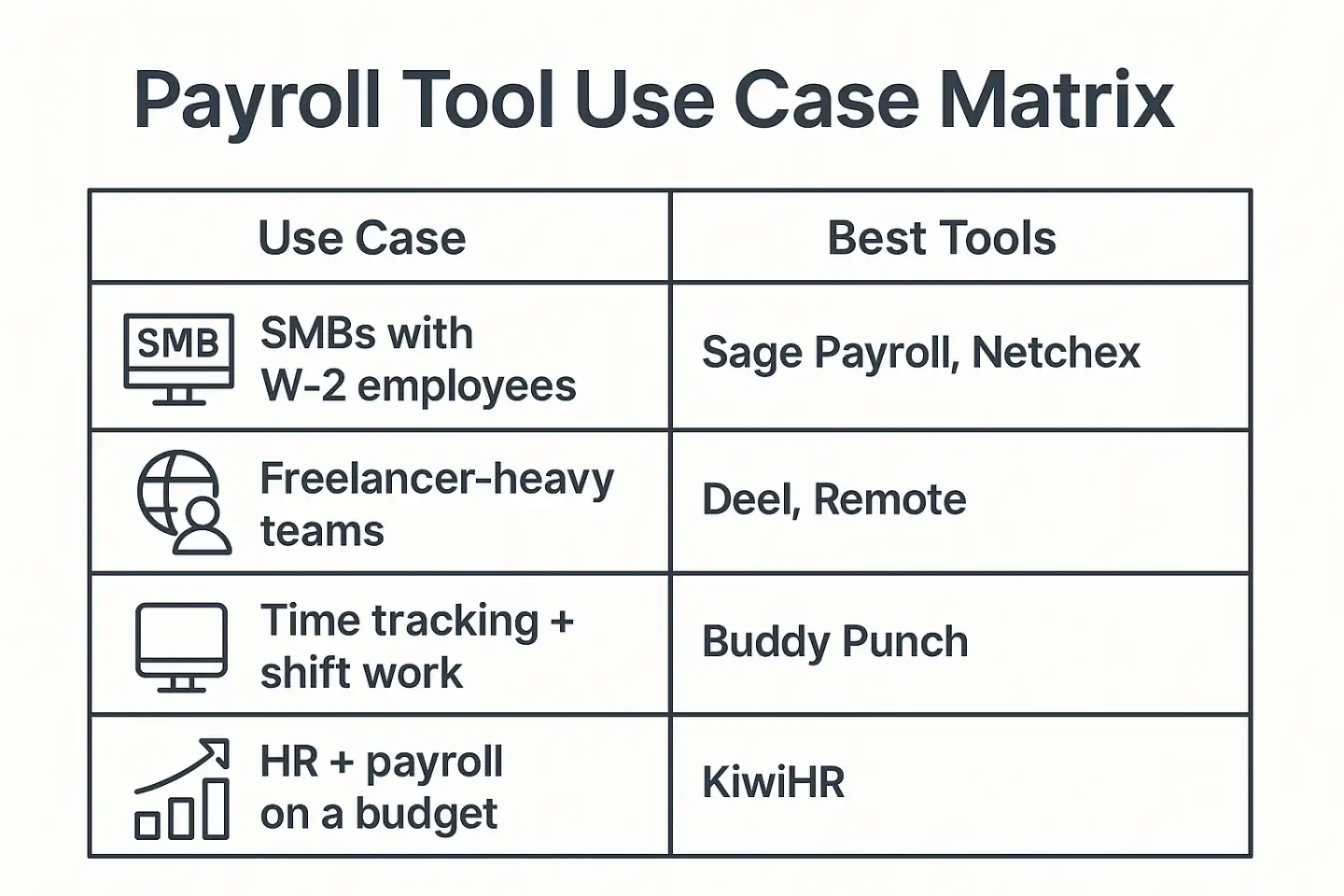

SMBs with W‑2 employees: If you have W-2 workers in your small or medium business, you can use Sage Payroll or Netchex.

Freelancer-heavy teams: If your team is full of freelancers, try Deel or Remote.

Time-tracking + shift work: Buddy Punch is good if your team’s work hours change or you need to track time.

Global firms hiring in U.S.: For the people who are working in a company that hires in the U.S. but is based somewhere else, use Papaya or Oyster.

All-in-one HR + payroll on a budget: If you want both HR and payroll in one simple product and don’t want to pay a lot, KiwiHR is a good pick.

State-level compliance: Be sure the tax filing software can do multi-state filings.

Employee vs contractor mix: Some tools work for both employees and contractors. Others are better for just one type.

Onboarding needs: Pick platforms that offer I-9 checks, places to keep documents, and digital signatures.

Integration stack: Make sure it works with the HR, accounting, and benefits tools you use now.

Scalability: Check that the software will grow with your team and keep up with legal needs.

The best payroll software in the U.S. is the one that gives you automation, keeps things accurate, and offers good support. Your pick will change based on how big your team is, the number of employees, what kind of employees you have, what you want to achieve, and if you work just in the U.S. or in other countries too, all tailored to your specific needs. Before making your final decision, the right payroll software helps you and your people feel at ease so you can focus on your work.

Try out demos or free trials when they are there. Make sure you choose platforms that fit with the way you work and meet your company’s rules and needs.

With the right payroll solution, you can save a lot of time each month. You will make fewer costly mistakes. Your employees will feel that they can trust you. You do not need to have a full HR team to do this.

For small business payroll, it's really important to follow tax rules. You should also pay attention to having direct deposit set up. When you pick software, find one that has an easy mobile app and clear pricing. This will help you feel sure you’re getting good value.

The best payroll software works smoothly with leading HR management solutions and systems. This link helps share data easily between both systems. It makes key jobs simpler, such as talent management, benefits administration, and employee management. This way, it provides a wide range of HR tools. In the end, it leads to a better way to manage the workforce.

Payroll software in Canada helps you keep up with US tax laws. It does this by automatically calculating taxes and making the required tax forms. The software stays updated with the latest tax regulations and payroll taxes. This gives you peace of mind and reduces the risk of penalties.