We test and review software products using an independent, multipoint methodology. If you purchase something through our links, we may earn a commission. Read about our editorial process.

Mistakes in paying employees cost U.S. businesses billions in penalties every year, so picking the right platform matters. Below is a lean, no‑fluff framework that walks a reader from definition to decision when evaluating your options.

When comparing top payroll software companies for 2026, first verify that each system applies real‑time federal, state, and local tax tables, automates end‑to‑end processing, and supports direct deposit options out of the box. If you manage cross‑border teams, confirm that the provider offers compliant global payroll software with multi‑currency support and localized tax filing.

Next, test usability on both desktop and mobile devices (or via a dedicated payroll app), and demand unlimited pay runs, role‑based access, and seamless sync with accounting systems such as QuickBooks Online to keep data accurate. Weigh the monthly price, length of any free trial, and customer support SLA so small‑business owners can adopt the best solution for their business without hidden fees or extra compliance headaches.

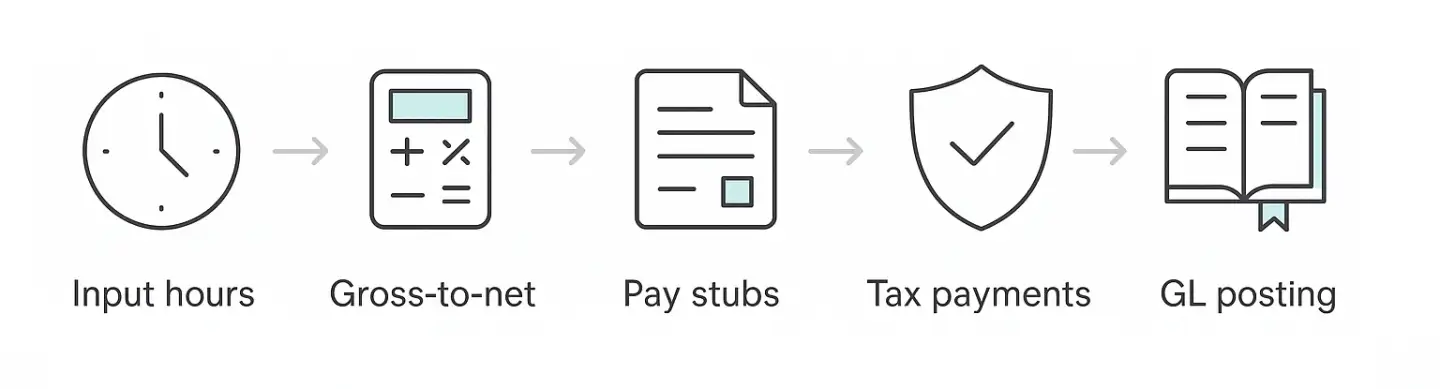

Payroll software is a rules‑driven application—most often cloud‑based—that automates every step of the process. It pulls employee hours or salary data, calculates gross‑to‑net pay, withholds federal, state, and local payroll taxes, and triggers direct deposit or check printing in one run.

By updating tax tables daily and keeping an audit trail of all payroll information, this payroll automation software replaces error‑prone spreadsheets, streamlines quarterly and year‑end tax filing (with automatic updates for new year tax changes), and syncs data to accounting systems like HelloBonsai for real‑time cost reporting.

Every top payroll platform should deliver the controls below; without them, accuracy, tax compliance, and cost tracking suffer.

Real-time tax engine — federal, state, and local tax tables that update daily.

Flexible pay runs — unlimited direct-deposit batches plus on-demand runs.

Employee self-service — secure web and mobile app access to W-2s, 1099s, and pay stubs.

Integrated time tracking — native clocks or two-way sync with leading time-and-attendance systems.

Multi-jurisdiction compliance — automatic flags for multi-state and 1099 rules.

General-ledger sync — live integrations with QuickBooks Online, NetSuite, and Xero.

Audit-grade security — immutable change log and role-based access controls.

This compact feature set is the baseline for any best-in-class solution in 2026.

Small businesses can enjoy error‑free paydays without hiring a full HR team by using payroll software for small businesses designed to meet their needs.

Accountants managing dozens of clients use payroll software for accountants to centralize multi‑entity pay runs and simplify tax filing.

Multinationals and fast‑growing startups rely on global payroll software to unify pay, taxes, and compliance across currencies and jurisdictions—delivering speed, accuracy, and audit‑ready records at scale.

For large businesses, top solutions integrate seamlessly with existing HR software or human resource management systems. This ensures the platform can handle complex requirements like multiple pay rates, diverse employee benefits packages, and multi-department operations with accuracy—supporting effective employee management at scale.

Start with the licensing model: per‑employee pricing scales predictably, while flat‑fee plans can save money once headcount rises. Check how the provider handles year‑end filings — automatic W‑2/1099 generation and e‑file services cut prep time and avoid “additional fee” surprises.

Review the depth of integrations with accounting systems, time‑tracking apps, and benefits or insurance carriers. For example, seamless connectivity to health insurance providers or retirement solutions (like a 401(k) plan service), or to an insurance carrier like NEXT Insurance for workers’ comp, ensures employee benefit deductions are accurate. Native, two‑way sync prevents data silos and payroll tax errors. Also consider any industry-specific requirements your business has. For example, the best construction payroll software will include certified payroll reporting for government contracts and handle union wage rates automatically, whereas a restaurant might need built-in tip management.

Finally, inspect the vendor’s support SLA — 24/7 live agents and tax penalty protection guarantees indicate confidence and protect long‑term ROI. Some payroll providers even include HR support via expert consultants or offer helpful resources (like compliance guides and best practices) to assist with human resource management issues beyond just HR issues as well.

During the initial setup process, you input company and employee personal information, define pay frequencies (payment schedules), overtime rules, benefits (e.g. health insurance contributions or retirement plan deductions), and state labor laws. The platform stores these policies and keeps tax tables current.

At each pay run, you import employee hours or salary data — via built‑in time tracking, CSV, or API — and the engine performs gross‑to‑net pay computations, ensuring accurate calculations and timely tax payments every time. It applies deductions (for benefits, garnishments, etc.), generates pay stubs, and triggers direct deposit. It then posts journals to QuickBooks Online (or another general ledger) and queues payroll reports and tax forms for e‑filing. In addition, a full‑service platform automatically handles periodic tax payments, tax deposits, and end of the year filings, giving you peace of mind about compliance — all in just a few minutes.

Automated processing trims run time by up to 80%, removes manual data entry, and even files taxes on time — dramatically slashing tax penalty exposure.

On‑time, accurate pay strengthens worker trust, while real‑time labor cost reports and general-ledger sync give finance teams instant labor‑cost visibility for better cash‑flow planning.

In 2026, the top payroll software solutions are secure cloud platforms that combine real‑time tax compliance with plug‑and‑play integrations for accounting, time tracking, and benefits. Even the most feature-rich system should still function as an easy payroll software for daily use by non-experts. Map those must‑have capabilities to your headcount, industry rules, and budget to choose a future‑proof solution. By following these best practices, you can ensure your process runs smoothly, giving you peace of mind and more time to focus on growing your business.

Once you’ve selected a platform, ensure a smooth implementation. Begin by migrating employee personal information and prior pay data into the new system. Take advantage of any free trial period by running a parallel pay run alongside your old process to catch discrepancies. Train your staff using the provider’s helpful resources or webinars, and don’t hesitate to leverage customer support channels for any questions. With thorough setup and training, you’ll quickly reap the benefits of automated accuracy and compliance.

For international teams, Papaya Global offers the most complete multi‑country compliance; for U.S. small businesses, Sage payroll software, Patriot Software, and Buddy Punch stand out for ease of use and pricing clarity.

ADP is the largest payroll provider in the U.S., issuing paychecks to tens of millions of workers every pay cycle.

ADP leads by revenue and market share, with Paychex and Intuit QuickBooks Payroll following in the second and third positions.

For UK small businesses, some providers offer free payroll software UK-wide. For example, HMRC’s Basic PAYE Tools is a free payroll software, but it has limited features. Most growing companies eventually outgrow free tools and opt for a full-service payroll software solution to ensure accurate tax calculations, proper payroll deductions, on-time filings, and dedicated customer support.