We test and review software products using an independent, multipoint methodology. If you purchase something through our links, we may earn a commission. Read about our editorial process.

In 2026, almost half of the small businesses in the U.S. will use Apple silicon devices to do their daily money work. That is why picking the right small business accounting software for Mac is so important. The best accounting software will help you stay up to date with all the rules. It works well with macOS and shows you your numbers as they happen. You won’t need to use a web browser trick or run Windows to get what you need. This makes it simple for any small business to handle its accounting and money tasks right on their Mac.

A good accounting software for small business on Mac should have a simple and clear general ledger. This helps make your financial reporting easy and keeps it free from mistakes. With small business accounting software, you will have your bank and credit card transactions come in every day. This helps you make sure everything matches up. The accounting software also has a payroll tool. This tool will work out your federal, state, and local taxes all at the same time.

Today’s Mac accounting software does much more than just the basic work. It can help you make invoices in different kinds of money and also create sales-tax reports by itself. A good choice will have a full mobile app for iOS or iPadOS, so you can look over and approve payments even if you are not at your desk. Role-based access makes sure your financial data stays safe and can only be seen by people who should see it. A modern system also comes with an open API. It will work with inventory management, ecommerce, and online-payment systems as soon as you set it up. So, you will not have to do any manual exports as your business grows.

Small business accounting software for Mac works well for owners who need tools that run quickly on macOS. You will not lose GAAP-level accuracy when you use this type of accounting software. The following types of users will get the most value from using small business accounting or small business accounting software:

Freelancers & solo consultants – easy invoicing and mileage tracking let you get paid faster. A free plan is there so you can keep spending low.

Service-based SMBs – track time billing, payroll, and sales-tax to help you keep the cash flow steady and right.

Product-focused SMBs – you can take care of inventory, purchase orders, and multi-currency payments all in one place, whether for your store or online.

High-growth startups – a chart of accounts that grows with you, so your business does not feel stuck. Get financial statements fit for investors, and use open APIs to keep up as your business grows.

Choosing small business accounting software for Mac can cost a lot. It is something you and your team will use for a long time. So, it is good to look at every option and compare them with clear and simple things. This will help you find the right accounting software for your business.

Price tiers – You need to look at what free choices there are, what they charge for each user, and if there is a limit on transactions. Make sure the total cost is good for your needs and fits with your budget.

Scalability – Check the data limits, how much it is to add more seats, and if upgrades can be done by you. This helps the system get bigger when you have more money and people.

Industry add‑ons – See if you can add things like inventory, project costs, or time tracking. With these, you do not have to use other tools.

Compliance – Check if there are features like GAAP-ready ledgers, automatic state sales tax, and fast e-filing for forms like 1099 or 941. These things help you skip doing the work by hand.

UI/UX on macOS – A system with menus for Mac, fast Apple chip use, and iCloud backup is great for mac users. It helps work feel easy, fast, and set up right.

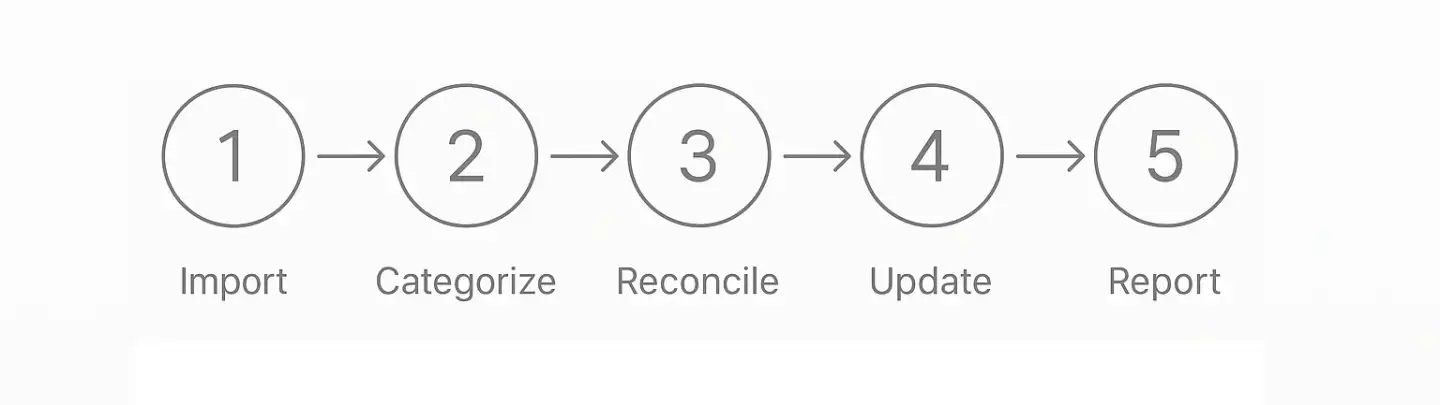

First, the small business accounting software for Mac will ask you to link every bank account and credit card you have. The accounting software takes each new transaction and puts it in the right spot in a set chart of accounts. This helps keep the double-entry rules in the general ledger in order. The software also uses rules to automatically put expenses into groups. If you need, you can use it to bring in old data by importing CSV files or QuickBooks Online records. This means Mac users can have a full and audit-ready set of accounting data in just minutes with this accounting software.

Every day, the desktop app or browser dashboard checks all your feeds, adds online payments, updates entries in inventory management, and uses the state sales-tax rates. When you approve payroll, it goes straight into the list of expenses. Real-time cash-flow widgets show you the key numbers you need. With just one click, the system will make financial statements that follow GAAP rules. These include profit-and-loss, balance sheet, and cash-flow reports. You can download these or share them safely with your accountants and investors.

Time savings – Automated bank feeds, payroll, and sales‑tax math get rid of the need to do manual entry. This lets small business owners do their bookkeeping in half the time each week.

Accuracy – By using double‑entry rules and real‑time checks, the general ledger stays clear of mistakes. This helps business owners cut down on mistakes that could cost them during tax season.

Real‑time insights – Dashboards show cash‑flow trends, inventory amounts, and profit numbers right as transactions update. This way, Mac users can see what is happening and act before a problem gets bigger.

Audit trail – Every edit and approval shows who did it, when they did it, and where. This gives accountants a clear and easy‑to‑look‑up record, which helps speed up the year‑end review and makes sure small business keeps to GAAP rules.

Choosing small business accounting software for Mac can feel like going through your own checklist. You want the software to be ready for GAAP rules. It should connect with your bank on its own and handle payroll. Keep an eye out for sales tax features. The software must also work well with Mac computers.

After these things, you need to check the price so it fits with what you make. Think about what extra things you may want to get. A good practice is to list down a few options like Xero, Zoho Books, Sage, Synder, Firstbase, and HelloBonsai. Make sure these small business accounting software choices cover what matters to you, like inventory management, your own chart of accounts, and helpful support. This helps the small business go smoother with the right accounting software.

Now, begin every candidate's free trial or starter plan and use it for a month. During this time, connect live bank data. Then, go through at least one pay cycle with it. Check how fast you get the right numbers. Look at how clear the reports can be and try using the mobile app. Place cash-flow dashboards from each side by side with each other. Look at them carefully. The one that gives you the most steady, real-time info and does not need much fixing by hand should be the one you pick for the business. That platform will stay at the center of the business's accounting work.

The safety of free accounting software can vary, but it often has features like encryption, user login checks, and data backups. Look for SSL/TLS protocols and make sure the software receives updates regularly. You should also check the vendor's reputation to protect your financial data. Always be aware of possible security problems and follow good habits for safe use.

When choosing accounting software for your small business, think about key features. Make sure it has invoicing, expense tracking, and financial reporting. It's also important to consider scalability. You should find out if it easily works with other tools. A simple design is important as well. Remember to think about data security and the support available for customers.

Using free accounting software can have some drawbacks. You might find that it has limited features and not enough customer support. There may also be concerns about data security. It is important to choose software that matches your needs. Be aware of these possible issues as your business grows.